Category: Mortgage

-

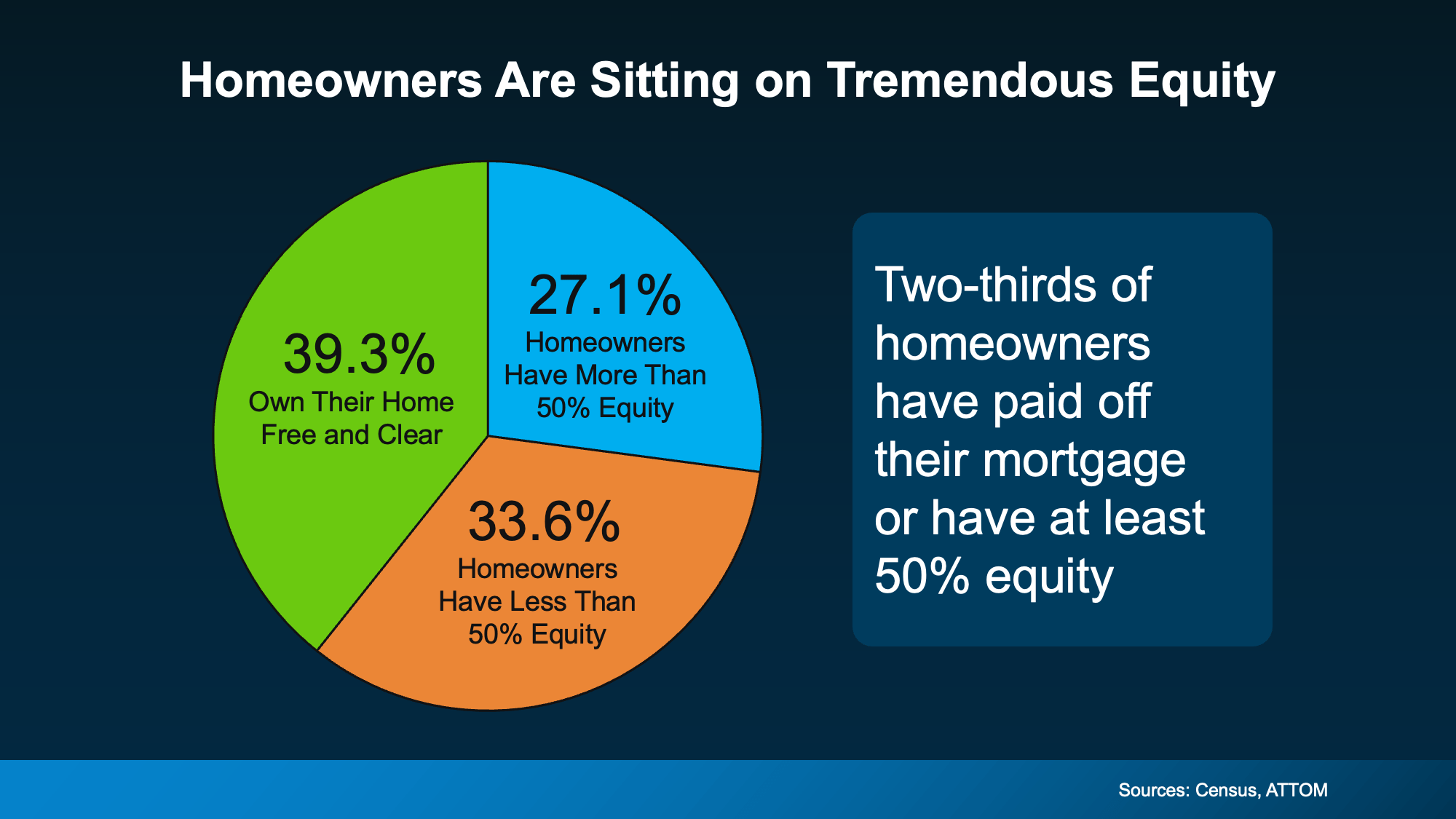

Sitting on Equity? Smart Moves for Homeowners!

Kentucky has been a popular destination for homebuyers for many years. In 2023, the real estate market in Louisville City will continue to be a hotbed of activity, with various properties available for purchase.

-

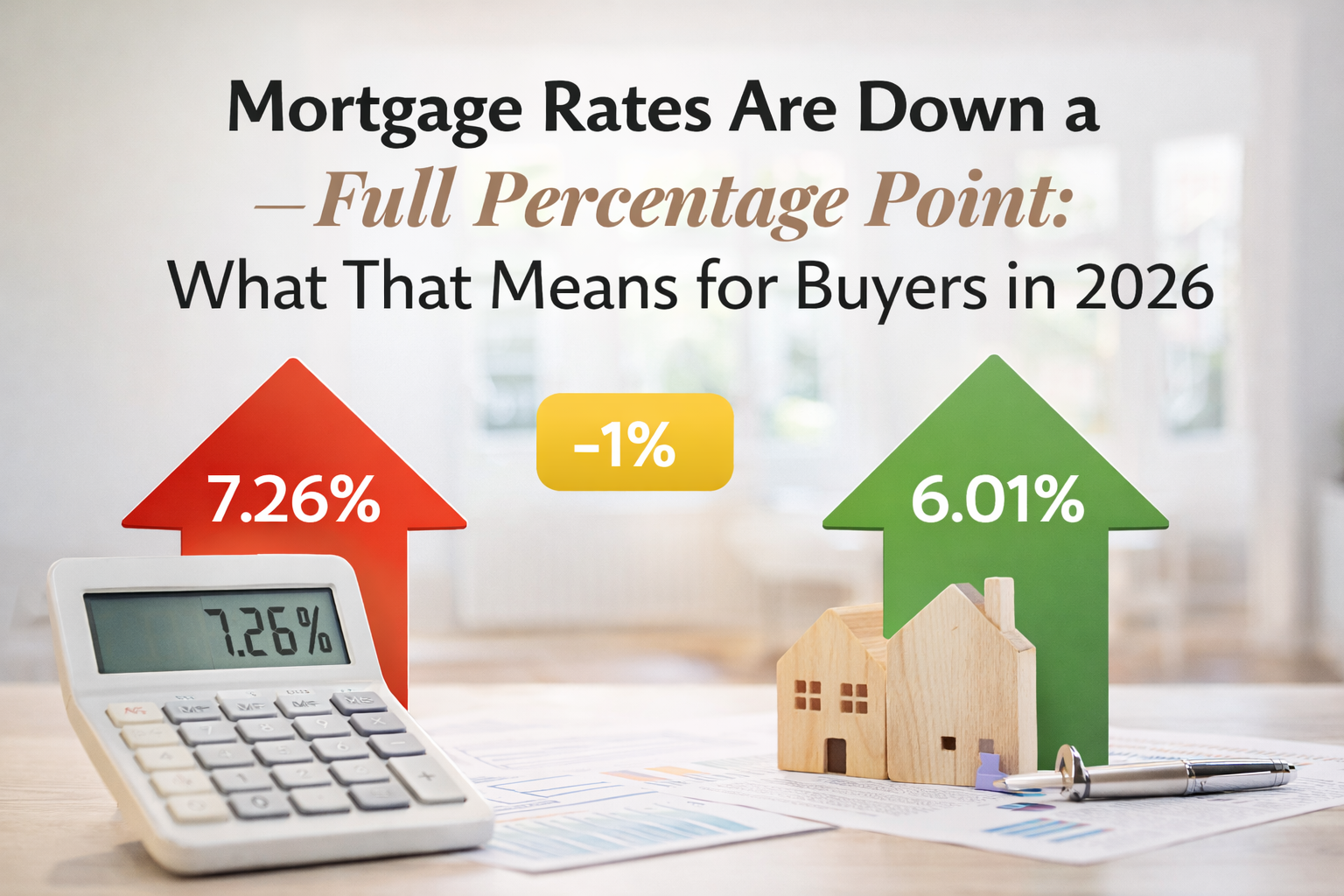

Mortgage Rates Just Hit a 3-Year Low and Why That Matters in Cape Coral & Louisville

Kentucky has been a popular destination for homebuyers for many years. In 2023, the real estate market in Louisville City will continue to be a hotbed of activity, with various properties available for purchase.

-

Mortgage Rates Are Down And the Math Finally Favors Buyers Again!

Kentucky has been a popular destination for homebuyers for many years. In 2023, the real estate market in Louisville City will continue to be a hotbed of activity, with various properties available for purchase.

-

Fed Rate Cut Expectations

Kentucky has been a popular destination for homebuyers for many years. In 2023, the real estate market in Louisville City will continue to be a hotbed of activity, with various properties available for purchase.

-

Ways Mortgage Services Help You With House Flips

Are you flipping a house and have questions? Read this blog to learn more about how mortgage services can help you with house flips.

-

Mortgage Fraud Red Flags: How Borrowers Can Protect Themselves

Navigating the mortgage landscape can be challenging, with numerous documents, legal terms, and financial decisions to consider. Unfortunately, the complexity of the process also leaves room for fraudulent activity that can exploit unsuspecting borrowers. By learning to recognize common warning signs and working with reputable mortgage brokers, you can safeguard your investment and protect your…

-

Top 3 Tips When Starting the Mortgage Process

Embarking on the journey to homeownership can be both exciting and overwhelming. Navigating the mortgage process is a critical step, and being well-prepared can significantly ease the stress. For prospective homebuyers, understanding the nuances of securing a mortgage is vital, especially when considering market trends and personal financial situations. Here, we present the top tips…

-

How to Improve Your Credit Score Before Applying for a Mortgage

Buying a home is an exciting milestone, but before you start house hunting, it’s crucial to ensure your financial health is in tip-top shape. One of the most important factors lenders consider when you apply for a mortgage is your credit score. A higher credit score not only increases your chances of approval but also…

-

Why NOT to Pay Off Your Mortgage Early

For a flexible mortgage that can include a fixed or adjustable interest rate and a low down payment, a conventional loan is a great choice.

-

5 Strategies for Paying Your Mortgage Off Early

For a flexible mortgage that can include a fixed or adjustable interest rate and a low down payment, a conventional loan is a great choice.