Category: Refinance

-

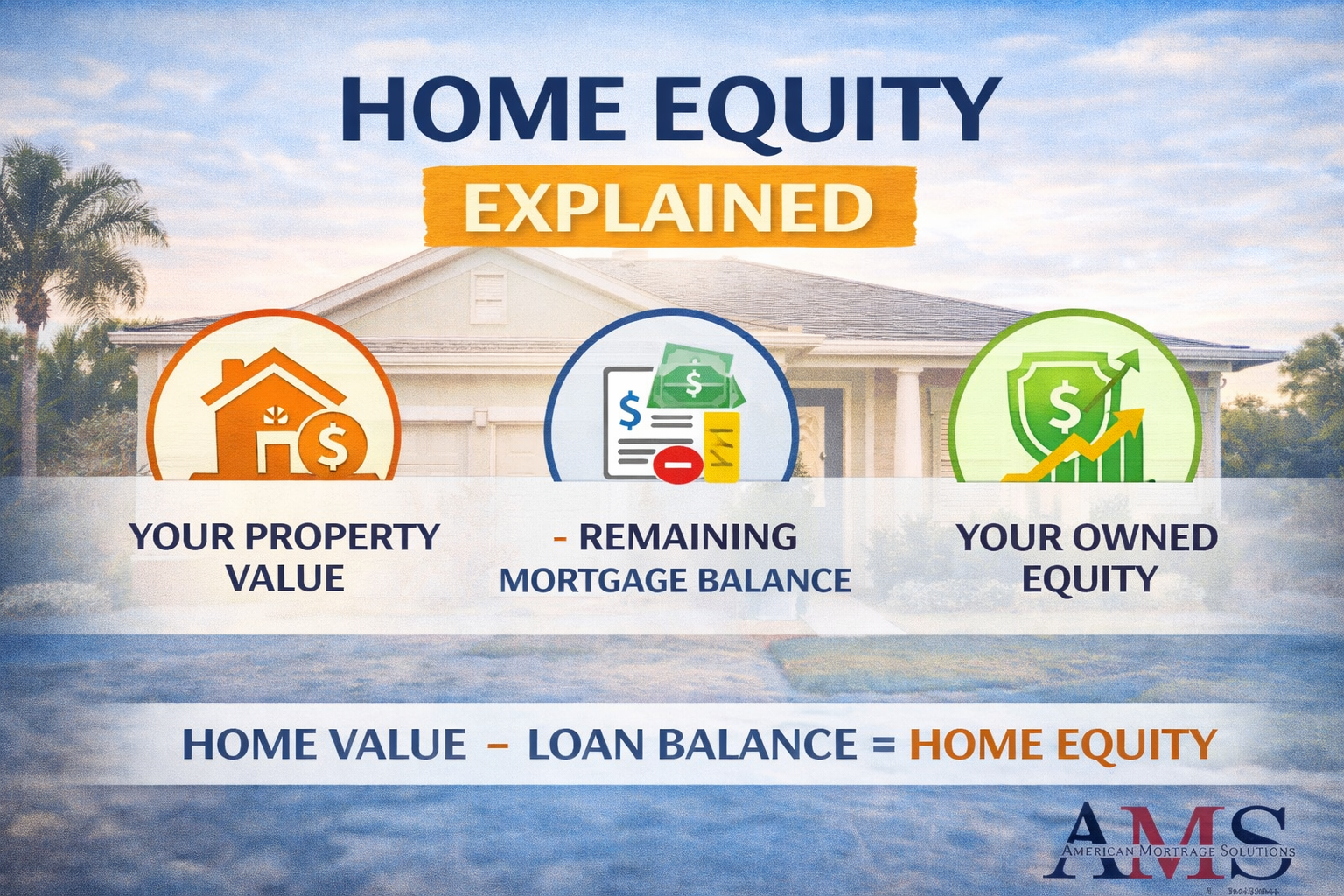

Home Equity Explained: Why Many Homeowners Are Considering Selling Right Now

The term “vetting” simply means to investigate or examine something carefully. In the context of divorce mortgage planning, vetting refers to the process of investigating and examining one’s finances and property to make sure everything is in order before finalizing a divorce.

-

How a Professional Broker Can Help You Refinance

Refinancing your mortgage can be a smart financial decision, but navigating the process alone can feel overwhelming. From comparing interest rates to understanding loan terms, the refinancing process involves numerous complexities. This is where a professional mortgage broker can play a critical role. Brokers act as intermediaries between borrowers and lenders, providing expert guidance and…

-

What to Know About Refinancing With Bad Credit

Refinancing a mortgage can be a strategic financial move for many homeowners seeking better interest rates or lower monthly payments. However, if you have bad credit, the process might seem daunting. Understanding the steps involved and knowing the options available can make refinancing more accessible, even with less-than-perfect credit. This blog post explores essential insights…

-

Can I Refinance with Bad Credit?

The term “vetting” simply means to investigate or examine something carefully. In the context of divorce mortgage planning, vetting refers to the process of investigating and examining one’s finances and property to make sure everything is in order before finalizing a divorce.

-

4 Common Mortgage Refinancing Myths

For a flexible mortgage that can include a fixed or adjustable interest rate and a low down payment, a conventional loan is a great choice.

-

4 Reasons Why You Should Refinance NOW

For a flexible mortgage that can include a fixed or adjustable interest rate and a low down payment, a conventional loan is a great choice.

-

Debunking Misconceptions About Mortgage Refinancing

The term “vetting” simply means to investigate or examine something carefully. In the context of divorce mortgage planning, vetting refers to the process of investigating and examining one’s finances and property to make sure everything is in order before finalizing a divorce.

-

What type of mortgage is an Equity Buy-Out?

The term “vetting” simply means to investigate or examine something carefully. In the context of divorce mortgage planning, vetting refers to the process of investigating and examining one’s finances and property to make sure everything is in order before finalizing a divorce.

-

Benefits and Reasons to Refinance Your Mortgage

The term “vetting” simply means to investigate or examine something carefully. In the context of divorce mortgage planning, vetting refers to the process of investigating and examining one’s finances and property to make sure everything is in order before finalizing a divorce.

-

When Should You Consider a Cash-Out Refinance?

The term “vetting” simply means to investigate or examine something carefully. In the context of divorce mortgage planning, vetting refers to the process of investigating and examining one’s finances and property to make sure everything is in order before finalizing a divorce.