American Mortgage Solutions

mortgage rates

Mortgage Rates Are Down Finally Favoring Buyers Again!

-

Brady Webb

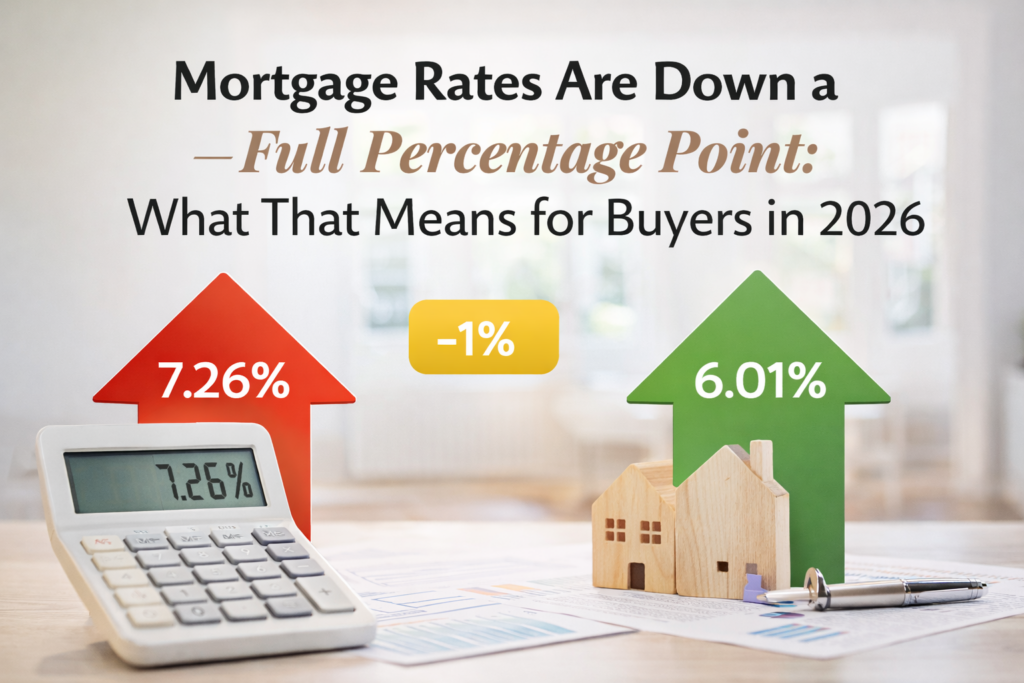

Over the past year, mortgage rates have quietly dropped by about a full percentage point. On paper, that may not sound dramatic. In real dollars, though, it’s a game-changer — especially for buyers who felt priced out just a year ago.

Let’s break down what that rate shift actually means using a very common scenario.

A Real Example: One Year Can Change Everything

Take a $400,000 home loan:

- January 2025 rate: 7.26%

- Principal & interest payment: $2,731.42

- January 2026 rate: 6.01%

- Principal & interest payment: $2,400.77

That’s a difference of $330.65 per month.

Over the life of a 30-year loan, that single-year rate change adds up to approximately $119,000 in savings.

Same loan amount. Same house. Very different outcome.

Why This Matters More Than Headlines Suggest

Many buyers focus on home prices alone. But interest rates drive affordability just as much — and sometimes more.

A one-percent rate shift can:

- Increase buying power

- Lower monthly payments

- Improve long-term financial flexibility

- Make qualifying easier for some buyers

For many households, that monthly savings is the difference between waiting and moving forward.

What This Means Locally

Mortgage rates have already started changing affordability for buyers in Cape Coral, FL and Louisville, KY.

On a typical $400,000 home loan, today’s lower rates can reduce monthly principal and interest by more than $330, while saving nearly $120,000 over the life of the loan.

Local market conditions still matter.

- In Cape Coral, strong demand and limited inventory mean buyers need every advantage they can get.

- In Louisville, improved affordability can help first-time and move-up buyers re-enter the market with more confidence.

Bottom Line

Lower mortgage rates don’t just make headlines — they change real outcomes. If buying a home didn’t make sense for you last year, it may be worth taking another look. A one-percent rate change can be the difference between waiting and moving forward.

If you want to talk through what this could mean for you locally, I’m always happy to break it down and look at real numbers.Contact Us (239) 766-8344 or (502) 327-9770.

Do you know how much home you can afford?

Most people don’t... Find out in 10 minutes.

Your Mortgage Broker in Cape Coral FL & Louisville KY. We are licensed in Florida, Kentucky, and Indiana.

- Services

- Blog

- Locations

- Contact

Copyright © 2026 | American Mortgage Solutions | NMLS: 1364/MB73346

Licensed in: FL, KY, IN

FL-MBR1574, KY-MB73346

Copyright © 2026 | American Mortgage Solutions | NMLS: 1364/MB73346

Licensed in: FL, KY, IN

FL-MBR1574, KY-MB73346

American Mortgage Solutions follows all Equal Housing laws. As prohibited by federal law, we do not engage in business practices that discriminate on the basis of race, color, religion, national origin, sex, marital status, age, because all or part of your income may be derived from any public assistance program, or because you have, in good faith, exercised any right under the Consumer Credit Protection Act. Disclaimer: Programs subject to change without notice. All borrowers must qualify per program guidelines.

These materials are not from HUD, FHA, the USDA, or the VA. These materials were not approved by any government agency. They are independent of any government agency. We are not in any way affiliated with any organization listed or referenced within this website, including HUD/FHA/USDA/VA. The inclusion of various education, information, web links, or materials are not an endorsement of the Sender or any of its employees or business partners. For information directly from HUD/FHA, visit https://www.hud.gov/guidance For information directly from the VA, visit http://www.benefits.va.gov/HOMELOANS/ For information directly from the USDA, visit http://www.usda.gov/wps/portal/usda/usdahome?navid=GRANTS_LOANS

American Mortgage Solutions is proudly powered by WordPress